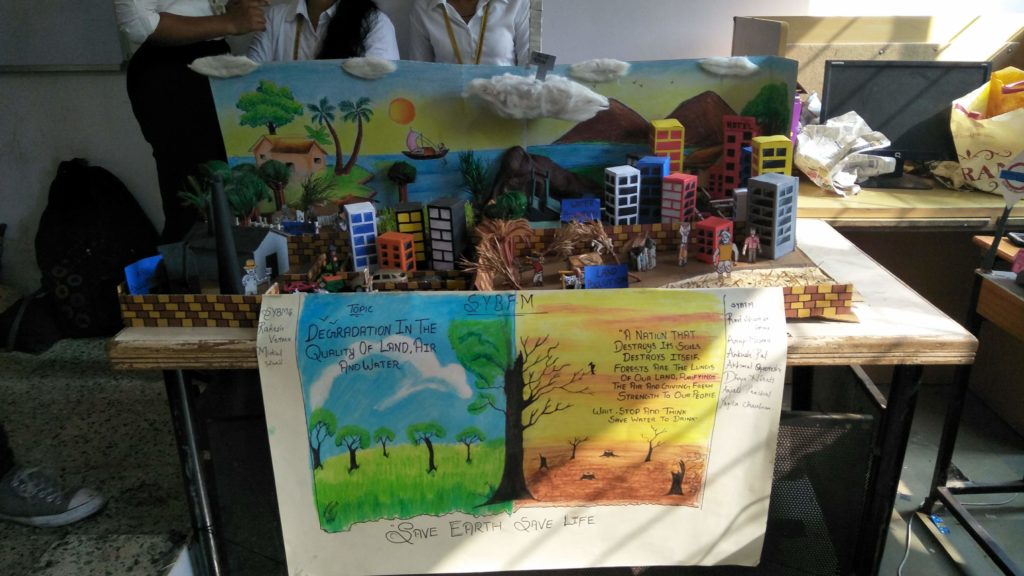

Whether one works as an executive or at entry level, the work environment now demands broadened mindsets and qualifications for diverse positions. The changing workforce, recent economic downturn and changing demographics are all contributors to this paradigm shift. Technical and specialized skills, honed to an art today, may indeed become obsolete in the near future. Furthermore, traditional degrees become outdated and even irrelevant in the modern workforce. It is essential that employees continue to expand their current knowledge base and skill sets to add personal value in their organizations. A specialized degree does just that, in addition to preparing the student for continued growth and life-long learning. It is with this objective in mind that the University of Mumbai has introduced two new Bachelor of Commerce degrees which encompass a shift from general education to professional education. These degrees aim at:

- Creating for the students of University of Mumbai an additional avenue of self- employment and also to benefit the industry by providing them with suitable trained persons in the field of Accounting & Finance. Banking and Insurance.

- Preparing students to exploit opportunities, being newly created in Banking & Insurance, Accounting and Finance as the profession due to Globalization, Privatization & Liberalisation.

- To provide adequate basic understanding about Banking, Insurance & other financial services to the students and to give an adequate exposure to operational environment in the field of Banking, Insurance & other related financial services of Accounting and Finance.

- To inculcate training, and practical approach, by organizing industrial visits, summer placements and using modem technology in teaching the students in the field of Banking & Insurance.